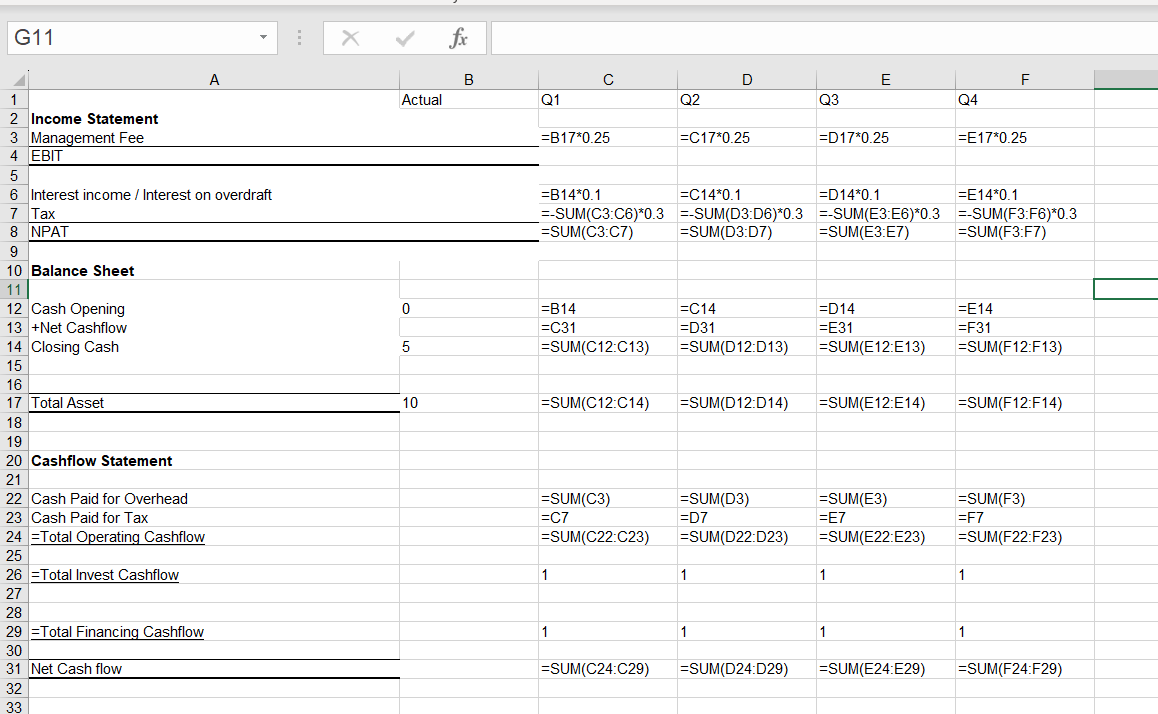

Hi, all, I am currently working on a 3 segment cashflow model within pigment. We are currently trying to model the operating cash flow but are stuck with an issue regarding a circular dependency.

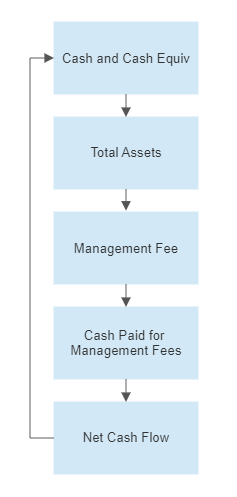

Within the model, we calculate cash flows (investing, operating and financing). The operating cash flows use management fees to calculate the tax paid, however the management fees are based on total assets which include cash and cash equivalents, which in turn is based on the net cash flow (derived from the combination of investing, operating and financing cash flows). This ends up with a circular reference. Our excel document avoids the circular reference by utilizing the net cash flow from the previous quarter, however doing this in pigment ends with the same circular reference